One of the non-life insurance policies you can avail of, home insurance, covers up expenses for your lovely house, an essential investment in life.

Home insurance in the Philippines lets you give a financial safety measure that protects your property from loss or damage financially. This also provides coverage for items inside your home such as appliances etc. Availing this kind of insurance will give you more than enough advantages and that peace of mind every night you sleep on your bed with your home and other valuable belongings secured.

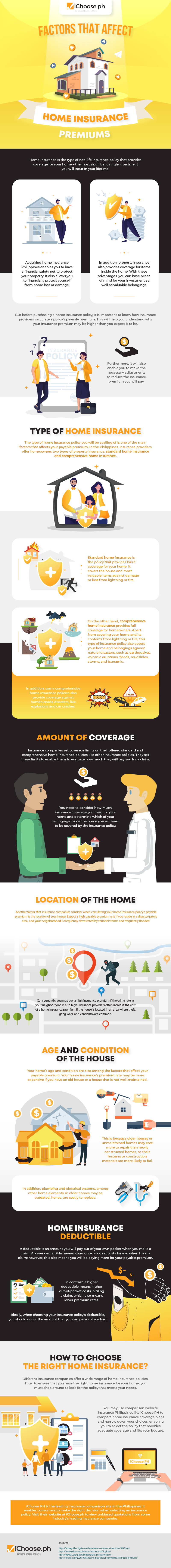

TYPE OF HOME INSURANCE

Payable premium or the package your home gets mostly depends on the type of insurance you availand affects home insurance premiums. In the Philippines, homeowners are offered two types of insurances from providers: standard and comprehensive home insurance.

Standard home insurance provides basic coverage for a home, alongside the valuable items inside it, against damage or loss from lightning or fire incidents.

While on the other hand, comprehensive home insurance is a policy that is complete coverage for homeowners. In simple terms, it is higher insurance than the standard one, where it has added benefits apart from what the first one has. This policy protects homes and belongings against natural disasters like earthquakes, volcanic eruptions, floods, mudslides, storms, and tsunamis. Some comprehensive home insurance covers man-made disasters like explosions and car crashes.

HOW TO CHOOSE THE RIGHT HOME INSURANCE?

As full of benefits as it seems, you can tell that home insurances can be pretty expensive, but with proper and careful canvassing, you can find a cheaper policy that suits you, your home, and your budget, which would be the best home insurance policy in the Philippines for you.

To learn more about the factors that affect home insurance premiums, you can read this infographic from iChoose PH.