In today’s rapidly evolving financial landscape, Forex Trading offers an exciting opportunity for individuals seeking to diversify their investment portfolios. Imagine having the ability to trade currencies from the comfort of your home, taking advantage of market fluctuations to generate returns. The allure of forex trading is undeniable, but success in this dynamic market requires more than luck—it demands a solid understanding of essential strategies.

Understanding the Forex Market

To excel in forex trading, it’s crucial to first understand the market dynamics. Forex, or foreign exchange, involves the simultaneous buying and selling of currencies. Each transaction is based on currency pairs, such as EUR/USD or GBP/JPY. The forex market operates 24 hours a day, five days a week, offering traders the flexibility to engage at their convenience.

Global economic factors significantly influence currency values. Traders must stay informed about geopolitical events, economic indicators, and central bank policies. Understanding these influences can help traders anticipate market movements and make informed decisions.

The Importance of a Trading Plan

A well-thought-out trading plan is the foundation of successful forex trading. This plan serves as a roadmap, guiding traders through their investment decisions. It outlines entry and exit strategies, risk tolerance, and performance evaluation criteria.

Creating a trading plan involves setting clear goals. Are you looking for short-term gains or long-term stability? Define your objectives and tailor your plan accordingly. A trading plan also helps traders stay disciplined and avoid impulsive decisions driven by emotions.

Risk Management Techniques

Effective risk management is paramount in forex trading. With the potential for significant gains comes the risk of substantial losses. Traders must adopt strategies to protect their capital and minimize risks.

One such strategy is setting stop-loss orders. These predefined levels automatically close a trade if the market moves against you, preventing further losses. Additionally, diversifying your portfolio by trading multiple currency pairs can spread risk and reduce exposure to any single market event.

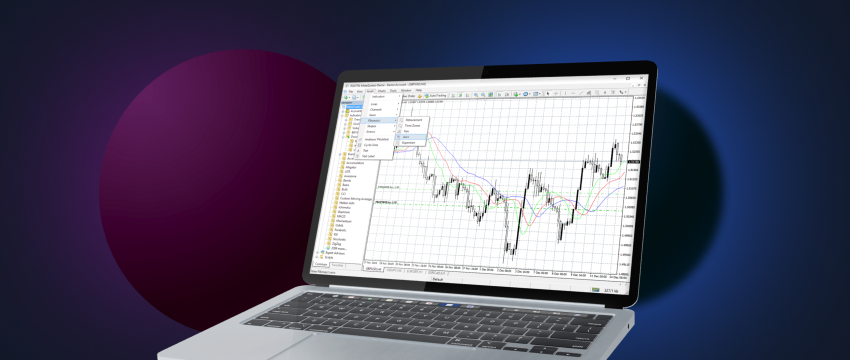

Technical Analysis for Informed Decisions

Technical analysis is a powerful tool that aids traders in predicting future price movements based on historical data. By analyzing charts and patterns, traders can identify trends, support and resistance levels, and potential entry and exit points.

Indicators such as Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements provide valuable insights into market dynamics. Traders use these tools to make informed decisions, increasing their chances of profitable trades.

Fundamental Analysis and Economic Indicators

In addition to technical analysis, fundamental analysis is essential for understanding the underlying factors driving currency movements. Economic indicators, such as GDP growth, inflation rates, and employment data, significantly impact currency values.

Traders must keep a close eye on economic calendars, monitoring key events that can trigger market volatility. By staying informed about global economic trends, traders can make well-informed predictions about currency movements.

The Role of Sentiment Analysis

Sentiment analysis provides insights into market psychology by gauging trader sentiment and behavior. It involves monitoring news reports, social media trends, and trader sentiment indices to understand the prevailing market mood.

Traders can use sentiment analysis to identify potential turning points in the market. For example, when sentiment becomes overly optimistic or pessimistic, it may signal an impending reversal. Understanding sentiment can help traders adjust their strategies accordingly.

Choosing the Right Trading Platform

Selecting a reliable trading platform is crucial for executing trades efficiently. Traders should prioritize platforms that offer user-friendly interfaces, real-time data, and robust security measures. Additionally, access to advanced charting tools and educational resources can enhance the trading experience.

Demo accounts provide an excellent opportunity for beginners to practice trading strategies without risking real money. They allow traders to familiarize themselves with the platform’s features and test their strategies before committing capital.

Psychology and Emotional Control

Mastering the psychological aspect of trading is vital for success. Emotional reactions, such as fear and greed, can cloud judgment and lead to poor decision-making. Traders must develop emotional discipline, adhering to their trading plans even during volatile market conditions.

Practicing mindfulness techniques, like meditation and deep breathing, can help traders maintain composure. Journaling trades and reflecting on emotional responses can also aid in identifying patterns and improving decision-making.

Staying Informed with Continuous Learning

The forex market is dynamic and constantly evolving. To remain competitive, traders must commit to continuous learning. Staying updated on market trends, new strategies, and technological advancements is essential for long-term success.

Joining online trading communities, attending webinars, and reading reputable financial publications are excellent ways to expand knowledge. Traders who invest in education gain a competitive edge and are better equipped to adapt to changing market conditions.

Adapting Strategies to Market Conditions

Markets are influenced by various factors, including economic data releases, geopolitical events, and natural disasters. Successful traders adapt their strategies to suit prevailing market conditions.

For instance, during periods of high volatility, traders might choose to employ shorter timeframes and tighter stop-loss levels. Conversely, during stable market conditions, longer-term strategies may prove more effective.

Building a Supportive Network

Networking with fellow traders can provide valuable insights and support. Joining trading forums and online communities allows traders to exchange ideas, share experiences, and learn from others’ successes and challenges.

Mentorship from experienced traders can also accelerate learning and provide guidance on navigating market complexities. A supportive network fosters accountability and motivation, helping traders stay focused on their goals.

The Path to Consistent Success

Consistent success in forex trading requires a combination of knowledge, discipline, and adaptability. By implementing the strategies outlined in this blog post, traders can enhance their decision-making, manage risks effectively, and capitalize on market opportunities.

Remember, forex trading is not a guaranteed path to riches, but with dedication and a strategic approach, traders can achieve their financial goals. Stay curious, keep learning, and watch your trading skills evolve over time.

In conclusion, successful forex trading hinges on a deep understanding of market dynamics, disciplined planning, and continuous improvement. By employing a holistic approach that encompasses technical and fundamental analysis, risk management, and emotional control, traders can confidently navigate the forex market. Whether you’re a novice or an experienced trader, the strategies outlined here can guide you toward achieving your trading ambitions.