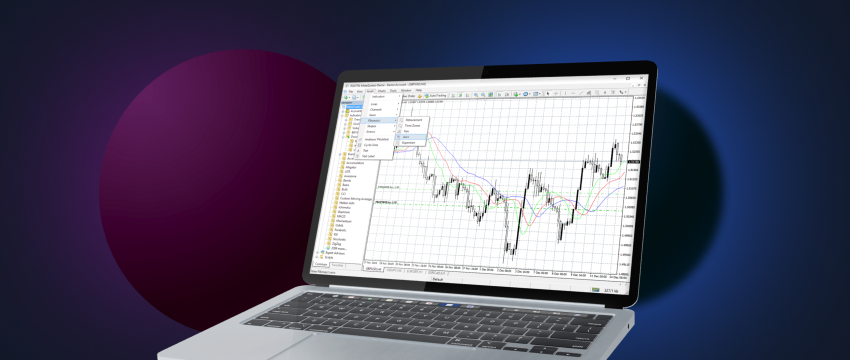

In the fast-paced world of forex trading, mastering the tools of the trade can make all the difference. Metatrader 4, often referred to as MT4, is one such tool that has become a staple in the trading community. Whether you’re a novice trader taking your first steps or a seasoned pro looking to refine your skills, understanding the ins and outs of MT4 can significantly enhance your trading experience. This article will guide you through the essentials, offering tips and strategies to help you get the most out of this robust platform.

Why Choose MetaTrader 4 for Your Trading Journey

MetaTrader 4 is renowned for its user-friendly interface and comprehensive feature set. It provides traders with real-time access to market prices, enabling them to make informed decisions quickly. But what truly sets MT4 apart is its adaptability; it suits both beginners and experienced traders alike. While some platforms can overwhelm new users, MT4 offers a gentle learning curve. For seasoned traders, it presents advanced tools and features that can support a wide array of trading strategies.

In addition to its ease of use, MT4 is equipped with powerful analytical tools. These tools include numerous charting options, technical indicators, and expert advisors, all designed to facilitate a deeper understanding of market trends. The flexibility to customize these tools ensures that you can tailor your trading environment to suit your personal style and strategy, making MT4 a versatile choice for anyone serious about trading.

Security is another key reason many traders prefer MT4. The platform employs high-level encryption to safeguard data, providing peace of mind when executing trades and managing accounts. This focus on security, combined with a global network of brokers, has established MT4 as a trusted platform in the world of forex trading.

Setting Up Your MetaTrader 4 Account

Setting up your MT4 account is the first step on your trading adventure. Begin by selecting a reputable broker that offers MT4 as a trading platform. It’s crucial to choose a broker that aligns with your trading goals and provides solid customer support. Once you’ve chosen a broker, download and install the MT4 software from their website.

After installation, you’ll need to create an account. This involves providing some basic information and verifying your identity. Most brokers offer demo accounts, which are a fantastic way to explore MT4’s features without risking real money. Demo accounts allow you to practice trading strategies in a risk-free environment, helping you build confidence before transitioning to live trading.

When your account is ready, familiarize yourself with the platform’s layout. MT4 is organized into various sections, including the Market Watch, Navigator, and Terminal windows. Understanding these components will help you efficiently manage your trades and access relevant information with ease. Take the time to explore each feature to ensure a smooth trading experience.

Navigating the MetaTrader 4 Interface

The MT4 interface is designed to be intuitive, yet comprehensive. At first glance, it might seem complex, but spending a little time exploring its various components will reveal its logic. The main screen displays charts where you can track the performance of different currency pairs. These charts are customizable, allowing you to adjust timeframes and apply technical indicators to suit your analysis needs.

On the left side of the screen, you’ll find the Market Watch window. This section displays real-time bid and ask prices for various financial instruments. It’s an essential tool for monitoring market movements and identifying trading opportunities. You can also access detailed information about each instrument, including spreads and daily highs and lows.

The Navigator window, typically located below the Market Watch, provides quick access to your accounts, indicators, expert advisors, and scripts. This is your command center for accessing and organizing your trading tools. Familiarize yourself with these sections to ensure you can quickly execute trades and manage your trading strategy effectively.

Customizing Your Trading Environment

One of the standout features of MT4 is its adaptability to individual trading preferences. Customization goes beyond mere aesthetics; it enhances functionality and efficiency. Start by adjusting chart properties to display the information that’s most important to you. You can change chart colors, add grid lines, and choose between different chart types, such as candlestick or line charts.

Technical indicators are another area where MT4 shines. With over 30 built-in indicators, and the ability to add custom ones, you can fine-tune your analysis to align with your trading strategy. Indicators like Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI) are popular choices that can help you identify trends and potential entry or exit points.

For those comfortable with coding, MT4 offers the ability to script and implement Expert Advisors (EAs). These automated trading systems can execute trades based on predefined criteria, freeing you from constant monitoring. EAs can be tested using historical data to refine their effectiveness, making them valuable tools for traders seeking consistent strategies.

Developing a Robust Trading Strategy

Successful trading relies on having a well-thought-out strategy. A robust strategy not only considers market conditions but also incorporates money management and risk assessment. Start by clearly defining your trading goals. Are you focusing on short-term gains, or are you more interested in long-term growth? Your goals will influence the type of strategies you develop.

Technical analysis plays a pivotal role in strategy development. Use the indicators available in MT4 to study price patterns and trends. For example, support and resistance levels can provide insights into potential price movements, helping you determine entry and exit points. Keep in mind that no strategy guarantees profit; the aim is to maximize potential while minimizing risk.

Risk management is another crucial component of a successful trading strategy. Determine how much of your capital you’re willing to risk on each trade, and set stop-loss orders in MT4 to prevent significant losses. By managing risk and sticking to your strategy, you can maintain a balanced approach that withstands market fluctuations.

Utilizing Technical Indicators Effectively

Technical indicators are the backbone of any trader’s toolkit. They offer insights that are often invisible to the naked eye. In MT4, indicators can be easily applied to charts to enhance your analysis. Begin with basic indicators like Moving Averages, which smooth out price data to highlight trends over time. They’re particularly useful for identifying buy and sell signals.

Oscillators, such as the Relative Strength Index (RSI) and the Stochastic Oscillator, are other popular indicators. These tools help assess whether an asset is overbought or oversold, providing potential reversal points. When combined with trend indicators, oscillators can strengthen your trading strategy by confirming price movements.

It’s important not to rely on a single indicator. Combining multiple indicators provides a more comprehensive view of the market. However, be cautious about overcomplicating your analysis. Too many indicators can lead to conflicting signals, so focus on a few that complement each other and align with your strategy.

Mastering the Art of Chart Analysis

Chart analysis is a fundamental skill for any trader. MT4 offers a variety of chart types and timeframes, allowing you to tailor your analysis to your trading style. Candlestick charts are particularly popular due to their ability to convey detailed information about price movements. Each candlestick represents a specific timeframe and shows the opening, closing, high, and low prices.

When analyzing charts, look for patterns like head and shoulders, triangles, and flags. These formations can signal potential price reversals or continuations. Trendlines and channels are also useful tools for identifying support and resistance levels. Regular practice and observation will help you recognize these patterns more easily.

Timeframes are another critical aspect of chart analysis. Shorter timeframes, such as 1-minute or 5-minute charts, are ideal for day trading, while longer timeframes, like daily or weekly charts, suit swing or position trading. By understanding how different timeframes interact, you can make more informed trading decisions.

Leveraging Automated Trading with Expert Advisors

Automated trading has gained popularity due to its ability to execute trades with precision and discipline. MT4’s Expert Advisors (EAs) provide traders with the opportunity to automate their strategies. EAs can monitor the market 24/7 and execute trades based on predefined rules, eliminating emotional influences from decision-making.

To get started with EAs, you’ll need to write or acquire a script that defines your trading strategy. This script can be tested using MT4’s Strategy Tester, which allows you to evaluate its performance using historical data. Backtesting is a crucial step that helps you refine your strategy before deploying it in live trading.

While automated trading offers several advantages, it’s important to remember that it’s not foolproof. Market conditions can change rapidly, and EAs may require adjustments to remain effective. Regularly review and update your EAs to ensure they continue to align with your trading goals and strategies.

Staying Informed with MetaTrader 4 News and Alerts

Keeping up with market news is essential for making informed trading decisions. MT4 provides access to real-time news updates directly within the platform. This feature allows you to stay informed about economic events, geopolitical developments, and other factors that can impact the markets.

In addition to news, MT4 offers customizable alerts that notify you of specific market conditions. These alerts can be set for price movements, technical indicator thresholds, or economic events. By configuring alerts, you can stay updated without constantly monitoring the platform.

Staying informed requires a proactive approach. Make it a habit to review economic calendars and news sources daily. Understanding how events affect currency pairs and other assets will give you an edge in your trading endeavors.

Building a Supportive Trading Community

Trading can be a solitary pursuit, but it doesn’t have to be. Engaging with a supportive trading community can provide valuable insights and encouragement. Many online forums and social media groups are dedicated to MT4 trading, offering a platform for sharing experiences, strategies, and tips.

Participating in these communities allows you to learn from others’ experiences and gain new perspectives on trading challenges. It’s also an opportunity to ask questions and seek advice from more experienced traders. Remember, every trader faces setbacks; a supportive community can help you overcome them.

Networking isn’t limited to online interactions. Consider attending trading seminars or workshops in your area. These events provide opportunities to connect with industry experts and fellow traders, broadening your understanding of the market and expanding your trading network.

Conclusion Elevate Your Trading Game with MetaTrader 4

Mastering MetaTrader 4 is a rewarding endeavor that opens doors to more effective and informed trading. By understanding the platform’s features, customizing your trading environment, and implementing strategic analysis, you can enhance your trading skills significantly. Remember, successful trading requires a combination of knowledge, discipline, and continuous learning.

Whether you’re just starting or looking to refine your existing strategies, MT4 has the tools and resources to support your trading goals. Stay committed to your trading plan, adapt to changing market conditions, and don’t hesitate to seek guidance from the trading community. With dedication and the right approach, you can unlock the full potential of MetaTrader 4 and achieve your trading aspirations.